Fill in a Valid Auto Insurance Card Template

Common mistakes

-

Failing to include the insurance identification card number. This number is crucial for verifying coverage.

-

Omitting the effective date or expiration date. These dates indicate the period during which the insurance is valid.

-

Incorrectly entering the vehicle identification number (VIN). This number uniquely identifies the vehicle and must be accurate.

-

Neglecting to provide the make/model of the vehicle. This information helps in identifying the insured vehicle.

-

Using outdated information for the company policy number. Always ensure the latest policy number is used.

-

Failing to sign or date the form. A signature is often required to validate the information provided.

-

Not keeping the card in the vehicle. This card must be readily available and presented upon demand.

-

Ignoring the instructions regarding the important notice on the reverse side. This notice may contain essential information.

-

Forgetting to report accidents to the insurance agent or company. Timely reporting is necessary for claims processing.

Learn More on This Form

-

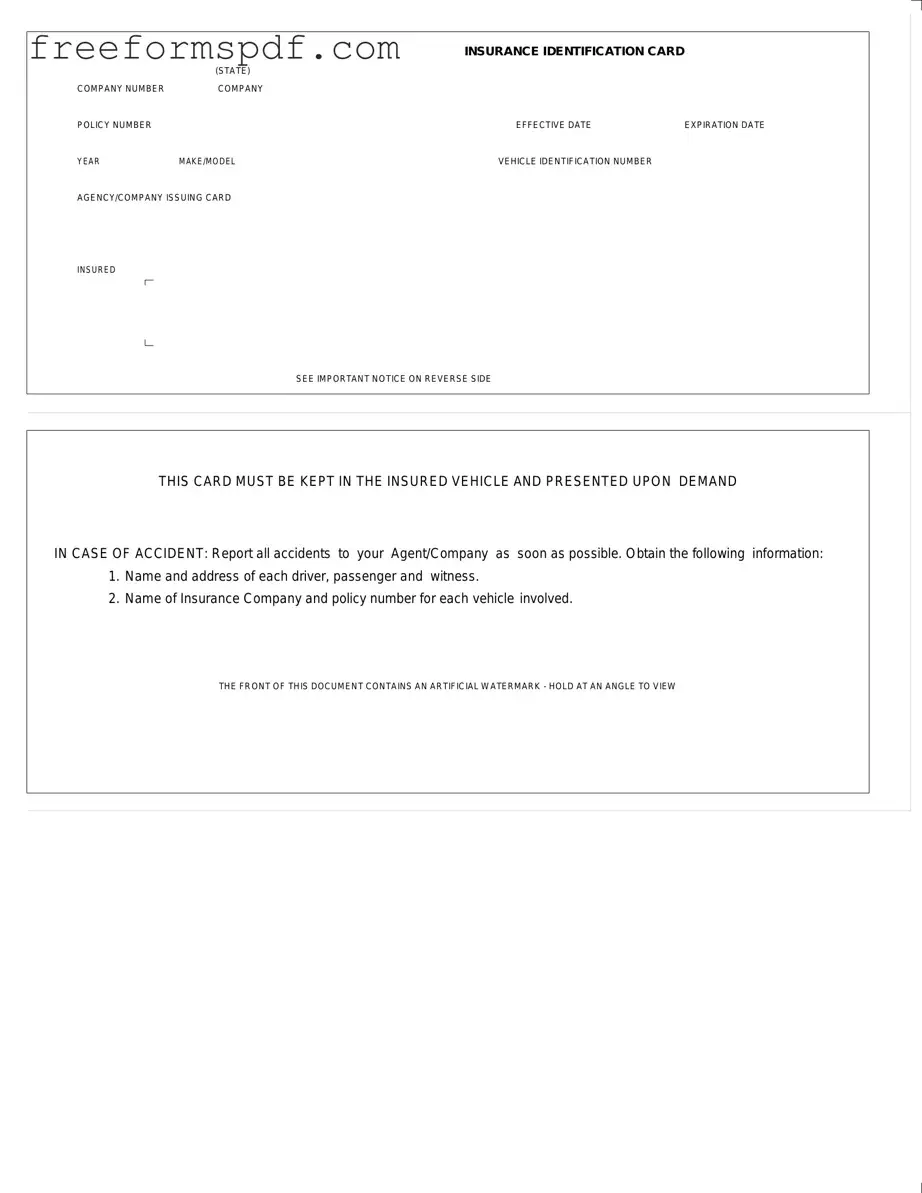

What is an Auto Insurance Card?

An Auto Insurance Card is an official document provided by your insurance company that proves you have valid car insurance. This card contains essential information about your insurance policy, including your policy number, the effective and expiration dates, and details about the insured vehicle.

-

Why is it important to keep the Auto Insurance Card in my vehicle?

It is crucial to keep the Auto Insurance Card in your vehicle because it must be presented upon demand in case of an accident or traffic stop. Law enforcement officers and other parties involved in an accident may request this information to verify that you have the required insurance coverage.

-

What information is included on the Auto Insurance Card?

The Auto Insurance Card typically includes the following information:

- Insurance Company Name

- Company Number

- Policy Number

- Effective Date

- Expiration Date

- Year, Make, and Model of the Vehicle

- Vehicle Identification Number (VIN)

- Agency or Company Issuing the Card

-

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can provide you with a replacement card. It’s important to have this document on hand to avoid any potential legal issues while driving.

-

What should I do in case of an accident?

In the event of an accident, report it to your insurance agent or company as soon as possible. Gather important information, including:

- The name and address of each driver, passenger, and witness

- The name of the insurance company and policy number for each vehicle involved

This information will be vital for processing any claims.

-

What does the artificial watermark on the card signify?

The artificial watermark on the Auto Insurance Card is a security feature designed to prevent fraud. By holding the card at an angle, you can view the watermark, which verifies that the document is legitimate and has not been altered.

-

How often should I check my Auto Insurance Card?

Regularly checking your Auto Insurance Card is a good practice. You should verify that all the information is current, especially before long trips or if you have made any changes to your insurance policy. Ensure that the effective and expiration dates are correct.

-

Can I use a digital version of my Auto Insurance Card?

Many states allow drivers to present a digital version of their Auto Insurance Card on a smartphone or other electronic device. However, it is essential to check your state’s regulations to confirm that this is permissible. Having both a physical and digital copy can be helpful.

Misconceptions

There are several misconceptions regarding the Auto Insurance Card form that can lead to confusion among vehicle owners. Understanding these misconceptions is crucial for proper compliance and use of the card. Below is a list of common misunderstandings:

- The card is not necessary to carry in the vehicle. Many believe that having auto insurance is enough, but the card must be kept in the vehicle at all times and presented upon demand.

- All information on the card is optional. In fact, the details such as the policy number and effective dates are essential for verifying coverage during an accident.

- The card is only needed for accidents. While it is crucial during accidents, the card also serves as proof of insurance for law enforcement and other situations.

- Only the driver needs to know about the card. All individuals involved in the vehicle, including passengers, should be aware of its location and importance.

- The card does not need to be updated. Changes in policy, vehicle, or coverage require an updated card to reflect accurate information.

- The watermark is just a design feature. The watermark serves a purpose; it helps to verify the authenticity of the card when viewed at an angle.

- It is acceptable to show a digital version of the card. While some states allow digital proof, others require a physical card. Always check local regulations.

- The reverse side of the card is unimportant. The reverse side contains important instructions and information that should not be overlooked.

Awareness of these misconceptions can help ensure that vehicle owners are properly informed about the Auto Insurance Card form and its requirements.

Browse More Forms

Chick Fil a Job - Access beneficial employee perks and discounts as part of the team.

The process of completing the NYCERS F170 form can be streamlined with the right resources, and for those looking for templates to assist in this endeavor, NY Templates provides a useful solution, ensuring that members have everything they need to successfully navigate their retirement options.

Fillable Child Care Receipt Template - This form serves as a receipt for child care services provided on a specified date.

Well Agreement - Clarifies that the agreement benefits and obligates future owners of the properties involved.