Fill in a Valid Advance Beneficiary Notice of Non-coverage Template

Common mistakes

-

Not reading the instructions carefully: Many people skip the instructions, which can lead to errors. Understanding the form's purpose and requirements is crucial for accurate completion.

-

Failing to provide complete information: Incomplete forms can delay processing. Ensure that all required fields are filled out, including personal information and details about the service or item in question.

-

Ignoring the timeline: Some individuals do not pay attention to deadlines. Submitting the form late can result in denial of coverage, so it's important to be aware of submission timelines.

-

Not understanding the implications: People often overlook the significance of the notice. It’s important to recognize that signing the form indicates an understanding that Medicare may not cover the service.

-

Overlooking signature requirements: Failing to sign the form is a common mistake. A signature is necessary to validate the notice and confirm that the recipient understands the information provided.

-

Not keeping a copy: Many forget to retain a copy of the completed form for their records. Keeping a copy can be helpful for future reference or in case of disputes regarding coverage.

Learn More on This Form

-

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

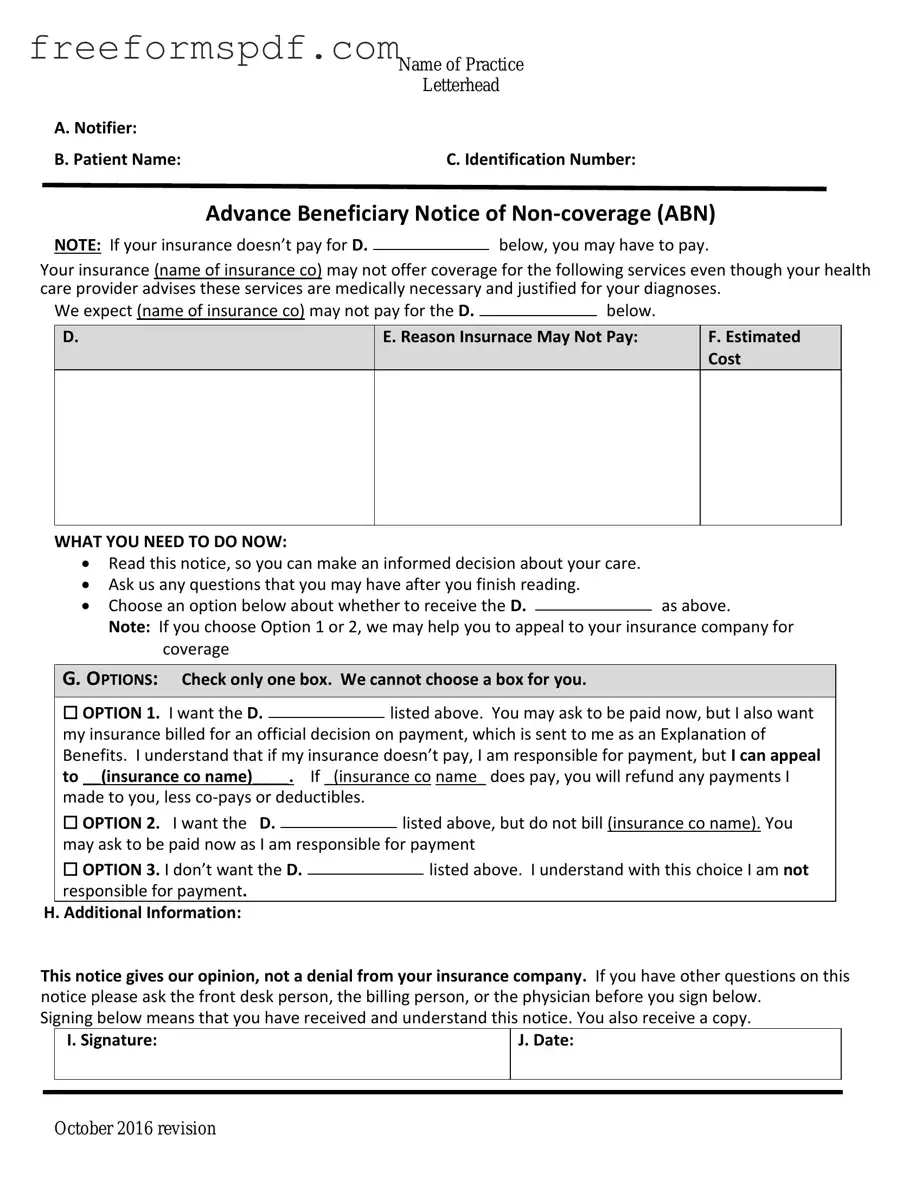

The Advance Beneficiary Notice of Non-coverage, commonly referred to as the ABN, is a document that healthcare providers give to Medicare beneficiaries. It serves as a notification that a particular service or item may not be covered by Medicare. By providing this notice, providers ensure that patients are informed about potential out-of-pocket costs before receiving the service.

-

When should I receive an ABN?

You should receive an ABN before a service is rendered if your healthcare provider believes that Medicare may deny coverage for that service. This typically occurs when a provider thinks that the service is not medically necessary or if it falls outside Medicare’s coverage guidelines. The notice should be presented in a timely manner, allowing you to make informed decisions about your care.

-

What should I do if I receive an ABN?

Upon receiving an ABN, carefully review the information provided. It will outline the specific service in question, the reason for the potential non-coverage, and your financial responsibilities should Medicare deny the claim. You have the option to either proceed with the service, understanding that you may be responsible for the costs, or to decline the service altogether. It’s advisable to ask your provider any questions you may have regarding the notice or the service itself.

-

What happens if I don’t receive an ABN but Medicare denies coverage?

If you do not receive an ABN and Medicare denies coverage for a service you received, you may have grounds to appeal the decision. In such cases, you can contact your healthcare provider to discuss the situation and ask for clarification on why an ABN was not issued. Understanding your rights is crucial, as you may not be held responsible for payment if the ABN was not provided when it should have been.

-

Can I appeal a decision made by Medicare regarding coverage?

Yes, you can appeal a Medicare coverage decision. If you believe that a service should have been covered, you have the right to file an appeal. The process typically involves submitting a request for reconsideration, along with any supporting documentation. It is essential to adhere to the deadlines set by Medicare for appeals, as these can vary depending on the type of service and the specific circumstances of your case.

Misconceptions

The Advance Beneficiary Notice of Non-coverage (ABN) form is often misunderstood. Here are four common misconceptions about this important document:

- Misconception 1: The ABN is only for Medicare beneficiaries.

- Misconception 2: Signing the ABN means you will definitely have to pay for the service.

- Misconception 3: The ABN is optional for healthcare providers.

- Misconception 4: The ABN is a denial of care.

While the ABN is primarily associated with Medicare, it can also apply to certain situations involving other insurance plans. It serves as a notification that a service may not be covered, regardless of the payer.

Signing the ABN indicates that you understand there is a possibility of non-coverage, but it does not guarantee that you will be responsible for the costs. Coverage decisions are made by the insurance provider after the service is rendered.

In certain situations, healthcare providers are required to issue an ABN when they believe a service may not be covered. Failure to provide an ABN in these cases can lead to billing issues later on.

The ABN does not deny care; rather, it informs patients about potential coverage issues. Patients can still choose to receive the service, but they should be aware of the financial implications.

Browse More Forms

Statement of Facts California Dmv - There are distinct steps for completing parts of the DL 44 for various needs.

The NYCERS F170 form plays an essential role for eligible members, and it is important for applicants to understand how to complete it accurately; for further details and templates, you can visit NY Templates, which provides helpful resources for the application process.

Goodwill Donation Receipt 2022 - This form is essential for claiming charitable donations on taxes.