Fill in a Valid Adp Pay Stub Template

Common mistakes

-

Incorrect Personal Information: Many individuals fail to verify their name, address, and Social Security number. This can lead to significant issues with tax reporting and benefits.

-

Wrong Pay Period Dates: It is common for people to mistakenly enter the wrong start and end dates for the pay period. This error can affect calculations and lead to discrepancies in pay.

-

Miscalculating Hours Worked: Some employees do not accurately track their hours or forget to include overtime. This can result in underpayment or overpayment, complicating payroll records.

-

Neglecting Deductions: Failing to account for deductions such as taxes, retirement contributions, and health insurance can lead to confusion about net pay. It's essential to review these carefully.

-

Ignoring Additional Income: Some individuals overlook reporting bonuses or commissions. This omission can lead to incorrect tax withholding and potential penalties.

Learn More on This Form

-

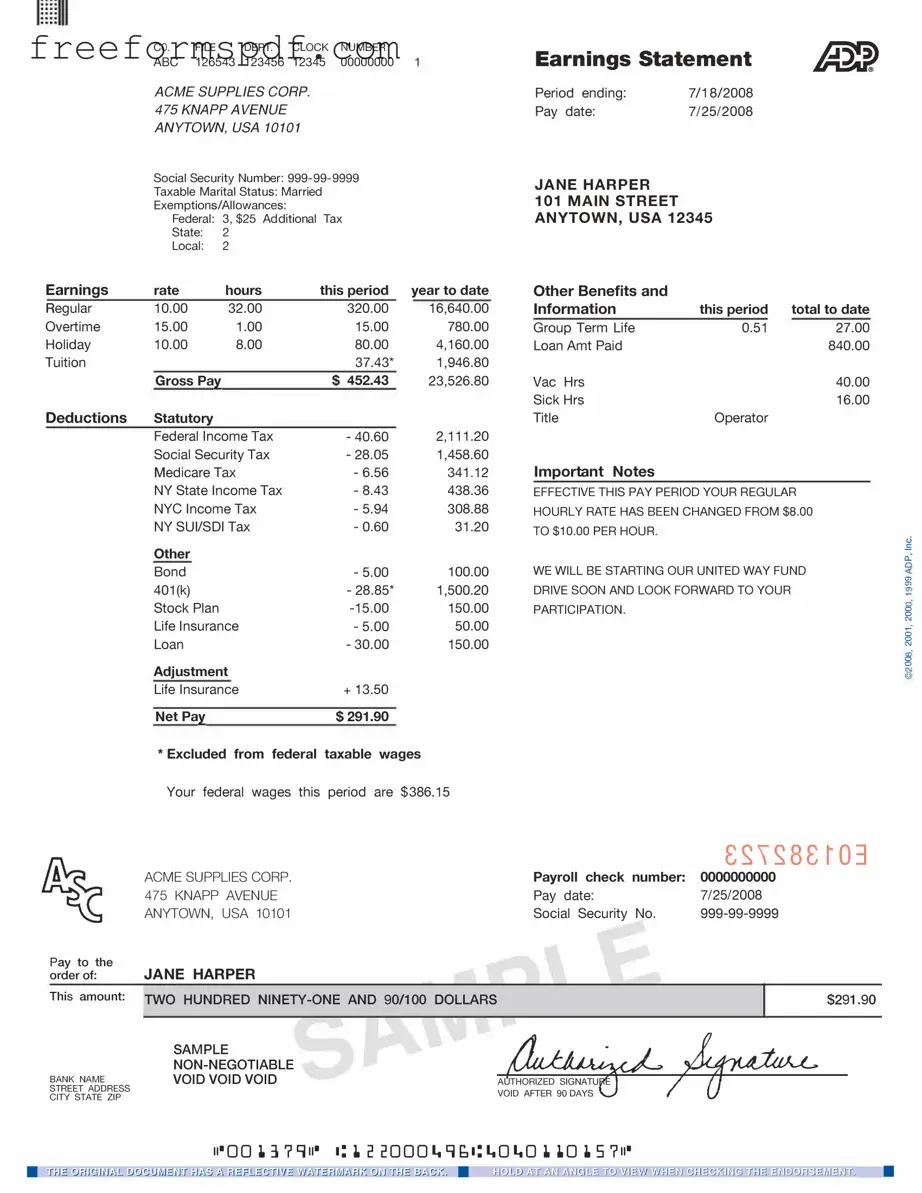

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It includes details such as gross pay, deductions, and net pay. Employees typically receive their pay stubs electronically or in paper form, depending on their employer's preferences.

-

How can I access my ADP Pay Stub?

To access your ADP Pay Stub, you can log into the ADP employee portal using your credentials. Once logged in, navigate to the 'Pay' section, where you will find your pay stubs listed by date. If you are unable to log in or have forgotten your password, you can use the password recovery option on the portal or contact your HR department for assistance.

-

What information is included on an ADP Pay Stub?

An ADP Pay Stub typically includes several key pieces of information:

- Employee name and ID number

- Pay period dates

- Gross earnings

- Deductions, such as taxes and benefits

- Net pay, which is the amount received after deductions

This information helps employees understand their earnings and the deductions taken from their pay.

-

What should I do if I notice an error on my ADP Pay Stub?

If you find an error on your ADP Pay Stub, it is important to address it promptly. First, review the details carefully to confirm the discrepancy. Then, contact your HR department or payroll administrator to report the issue. They will guide you through the process of correcting any mistakes and ensuring that your pay is accurate moving forward.

Misconceptions

Many people have misunderstandings about the ADP Pay Stub form. Here are six common misconceptions:

- Misconception 1: The pay stub shows only the gross pay.

- Misconception 2: The pay stub is only for employees on a salary.

- Misconception 3: The deductions listed are always accurate.

- Misconception 4: Pay stubs are not important for tax purposes.

- Misconception 5: You can’t access past pay stubs.

- Misconception 6: The format of the pay stub is the same for all employers.

This is not true. The pay stub includes gross pay, deductions, and net pay, providing a complete picture of earnings and withholdings.

Both hourly and salaried employees receive pay stubs. Regardless of how you are paid, the pay stub is essential for understanding your earnings.

While ADP strives for accuracy, errors can occur. If something seems off, it’s important to review your pay stub and address discrepancies promptly.

Pay stubs are crucial for tax preparation. They provide documentation of your earnings and withholdings, which you may need when filing your taxes.

ADP allows employees to access previous pay stubs online. You can usually retrieve them for several years, depending on your employer's policies.

Each employer may customize their pay stub format. While ADP provides a standard layout, individual companies can add or modify details based on their needs.

Browse More Forms

Owner Operator Lease Agreement - Notices between the parties must be delivered in writing, using certified or registered mail.

The California Lease Agreement form is a legally binding document that outlines the terms and conditions between a landlord and a tenant for rental property in California. This form sets clear expectations on aspects such as rent amount, lease duration, and responsibilities of both parties. Understanding and properly filling out this form is essential to avoid disputes and ensure a smooth rental experience, so for additional resources, you may visit PDF Documents Hub to aid in the process.

Dog Vaccination Booster Late - A proactive measure in preventing kennel cough outbreaks.