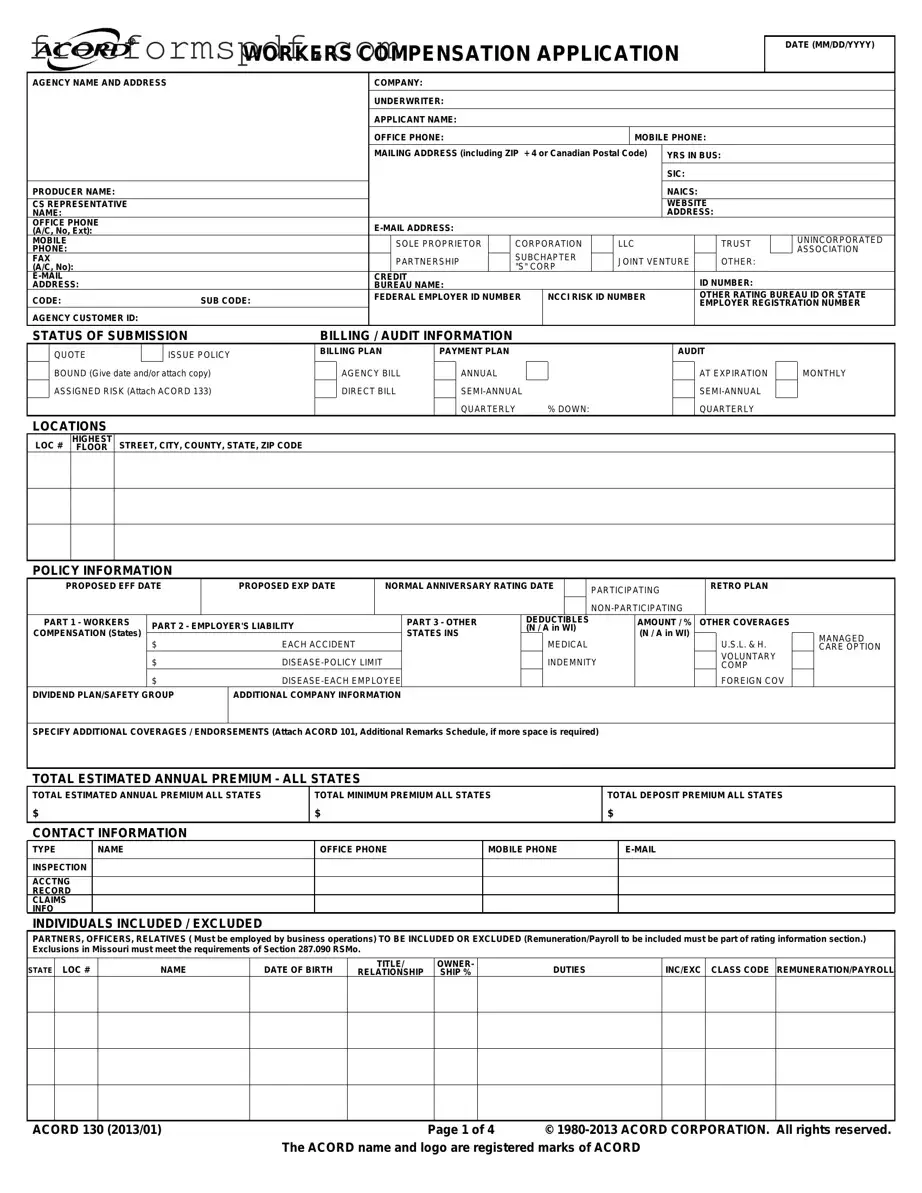

Fill in a Valid Acord 130 Template

Common mistakes

-

Incomplete Contact Information: Failing to provide all necessary contact details, such as office phone numbers and email addresses, can delay communication and processing of the application. Ensure that all fields are filled out completely.

-

Incorrect Dates: Entering the wrong dates for the application or proposed effective dates can lead to confusion. Double-check all date entries to ensure accuracy.

-

Omitting Employee Information: Neglecting to include all employees, especially those who should be included or excluded, can result in incorrect premium calculations. Carefully review the section regarding individuals included or excluded from coverage.

-

Misclassifying Business Operations: Using incorrect SIC or NAICS codes can misrepresent the nature of the business, leading to inappropriate coverage or premium rates. Verify that the classifications accurately reflect the business activities.

-

Inaccurate Loss History: Providing incomplete or inaccurate loss history can raise red flags during underwriting. It is essential to include all relevant claims information for the past five years.

-

Neglecting Additional Coverages: Failing to specify any additional coverages or endorsements needed can leave gaps in protection. Review the coverage options carefully and attach any necessary documentation.

Learn More on This Form

-

What is the purpose of the ACORD 130 form?

The ACORD 130 form is primarily used to apply for workers' compensation insurance. It collects essential information about the applicant's business, including details about their operations, employee classifications, and coverage needs. By completing this form, businesses can obtain quotes and establish policies that provide necessary protection against workplace injuries and liabilities.

-

What information is required on the ACORD 130 form?

The form requires a variety of information, including the applicant's name, address, and contact details. It also asks for business specifics such as years in operation, type of business entity (e.g., corporation, LLC), and the nature of operations. Additionally, details about employee classifications, estimated payroll, and prior insurance history must be provided. This comprehensive data helps insurance providers assess risk and determine appropriate coverage options.

-

How does the ACORD 130 form affect insurance premiums?

The information submitted on the ACORD 130 form directly influences the calculation of insurance premiums. Insurers evaluate factors such as the nature of the business, employee classifications, and previous claims history to assess risk. The estimated annual payroll and the number of employees also play a significant role in determining the premium amount. Accurate and complete information can lead to more favorable rates, while discrepancies may result in higher costs.

-

What should be done if there are changes in the business after submitting the form?

If there are any changes in the business operations, such as a change in the number of employees or a shift in the nature of the work, it is crucial to notify the insurance provider as soon as possible. Such changes can impact coverage needs and premium calculations. Keeping the insurer informed helps ensure that the business remains adequately protected and compliant with the terms of the policy.

-

Are there any exclusions or limitations to be aware of when using the ACORD 130 form?

Yes, certain exclusions and limitations may apply based on the information provided. For instance, specific activities or classifications might not be covered under standard workers' compensation policies. Additionally, states like Wisconsin may have unique stipulations regarding coverage. Therefore, it is essential to review the policy terms carefully and discuss any concerns with the insurance provider to understand the scope of coverage fully.

-

What happens if false information is provided on the ACORD 130 form?

Providing false information on the ACORD 130 form can have serious consequences. It may result in denied claims, cancellation of the policy, or even legal repercussions for committing fraud. Insurers take discrepancies seriously, and the penalties for misrepresentation can include fines or imprisonment, depending on the severity of the offense. Therefore, it is vital to ensure that all information submitted is accurate and complete.

Misconceptions

Understanding the Acord 130 form is crucial for anyone involved in workers' compensation insurance. However, several misconceptions can lead to confusion. Here’s a breakdown of seven common myths:

- Myth 1: The Acord 130 form is only for large businesses.

- Myth 2: Completing the form is optional.

- Myth 3: The form is straightforward and requires minimal detail.

- Myth 4: Only the owner needs to be listed on the form.

- Myth 5: The Acord 130 form can be filled out quickly without much thought.

- Myth 6: Once submitted, the information is permanent and cannot be changed.

- Myth 7: The Acord 130 form is the only document needed for workers' compensation insurance.

This is not true. The Acord 130 form is applicable to businesses of all sizes, from sole proprietors to large corporations. It is designed to gather essential information for workers' compensation coverage regardless of the company's scale.

In fact, completing the Acord 130 form is often a mandatory step in obtaining workers' compensation insurance. Insurers require this information to assess risk and determine appropriate coverage.

While the form may seem simple, it requires detailed information about your business operations, employee classifications, and payroll. Missing details can lead to delays or issues with your coverage.

It's essential to include all relevant individuals, such as partners and officers, who are involved in the business. This ensures accurate coverage and compliance with state regulations.

Rushing through the form can lead to errors or omissions. Take the time to carefully review each section to ensure accuracy and completeness.

This is a misconception. If your business circumstances change, you can update the information with your insurance provider. Keeping your details current is vital for maintaining appropriate coverage.

While it is a key document, additional forms or information may be required depending on your specific situation or state regulations. Always check with your insurance agent to ensure you have everything necessary.

Being informed about these misconceptions can help you navigate the workers' compensation process more effectively. Don’t hesitate to reach out to your insurance agent for clarification and assistance.

Browse More Forms

How to Get Your Marriage Certificate - Can help in acquiring homeowner loans and mortgages together.

When navigating the incorporation process, it is important to utilize resources that provide templates and forms. One such resource is NY Templates, which offers a variety of options to ensure that the New York Certificate form is completed correctly and efficiently, aligning with the legal requirements set forth by the state.

Free Printable Direction to Pay Form - Collects information about the vehicle's make, model, and year.

Lien Release Requirements by State - The Final Waiver of Lien reflects a formal closure of the contract.